Granite Capital Group Outlook Update

March 2023

Summary

The United States has enjoyed a period of uninterrupted economic growth for over a decade, but that era has fundamentally changed. The Federal Reserve’s 2022 decision to curtail inflation holds the potential for economic disruption not seen since 2008. The root cause is an unprecedented increase in inflation and the Fed’s rapid fire interest rate increases in response. The effect of this unique economic event is evolving, but housing, as always, is the first to be impacted by interest rates. Housing is further straddled with significant supply constraints which as a result, makes the outlook for investment in rental real estate worth closer examination. At Granite Capital Group we have been analyzing the data and comparing it to historic information to formulate our thinking and investment strategy.

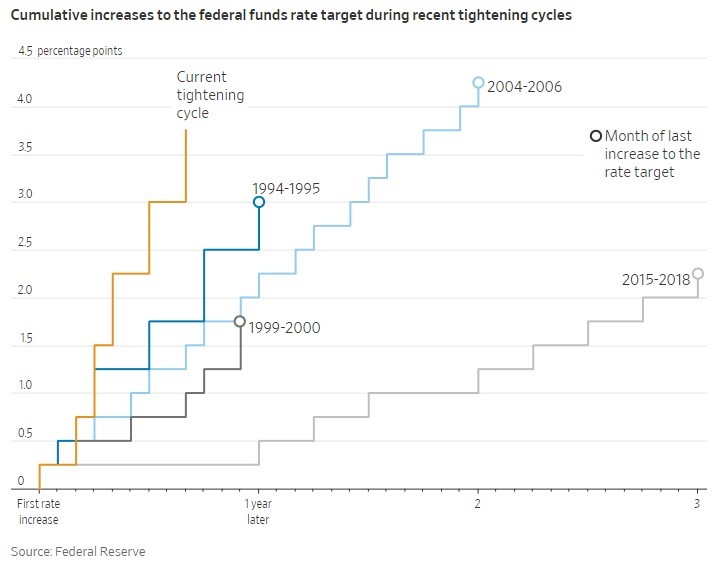

Driving the Federal Reserve’s (the Fed) reaction is their dual responsibility to maintain price stability while maximizing employment. With inflation at a multi decade high the Fed has embarked on slowing inflation and stabilizing pricing by raising interest rates. Federal Reserve Chair Jerome Powell said that to lower inflation to its goal of 2% it “is likely to take quite a bit of time. It’s not going to be, we don’t think, smooth.” As we are writing this update, the Fed has increased the Federal Funds rate from near-zero to approximately 5%, with individual interest rate hikes that started at 0.75% and tapered to 0.25%. To measure the effect of these increases, the agency has begun to soften their approach with less aggressive rate hikes. The question is now changing from, “how high will rates go” to “how long will the new higher rates last?” “The Committee i s strongly committed to returning inflation to its 2 percent objective,” the Federal Reserve stated in their February 1, 2023 statement. Ultimately, what will be the final effect on the economy? Holding rates high for a prolonged period could, and likely will, cause a hard landing for the economy. So, what does this mean to multifamily investors?

Different Interest Rate Durations Have Different Influences

To view rates in a useful manner we must separate short-term rates from long-term rates and examine their effects on commercial real estate separately. Short-term rates immediately affect existing real estate debt such as variable-rate loans, bridge loans (used to buy value-add “fixer” properties), and construction loans. Long-term rates, which are often based on 7 or 10-year treasury notes, affect permanent long-term fixed-rate financing, the primary vehicle for buying existing stabilized multifamily property. The changes in short-term rates on variable-rate loans could lead to defaults, while higher long-term rates eventually cause a reduction of cashflow and value. Both short and long-term rates will have a part to play in the newly emerging commercial real estate market.

New Supply in Housing

Housing is drastically under supplied throughout the United States. Freddie Mac in their October 2022 report noted that in 2019 we were 3.8 million units short of meeting the current nationwide housing demand (2019 was the best number available according to Freddie Mac). Since 2019, Freddie Mac believes the deficit has increased due to Covid and supply shortages. Basic economics tells us a supply shortage of this magnitude results in higher prices.

In the short term, however, we will see lower prices due to higher interest rates while over the next 3 to 5 years we expect the housing shortage to see increased housing demand driving values, and rents. In markets where the current construction pipeline of units outweighs demand (e.g., Las Vegas, Phoenix, Austin, and Salt Lake) we expect to see additional price softening leading to higher vacancy resulting in near term lower rents, further exacerbating declines in pricing.

Nevertheless, we believe as the Fed begins to reduce the Fed Funds rate in 24 to 36 months, we will be in a stable long-term market that benefits from housing shortages making rental housing ownership the beneficiary.

What We Expect Over the Next 24 Months

Higher interest rates will affect each real estate investor differently and will do so over the near and intermediate terms.

Investors will be affected differently and at different points in this new cycle:

- Investors who must refinance from a variable-rate, bridge, permanent, or construction loan.

- Owners who must sell (e.g., funds that have reached their maturity date or whose portfolio requires rebalancing), those who are estate planning, those planning for significant life changes, and new construction owned by merchant builders who must cash out to replenish working capital or payoff equity investors.

- Those with cashflow problems occasioned by higher interest rates, problem markets that might be experiencing declining rents or other unique reasons such as portfolios that require capital to be raised.

- Last in line are sellers that view the market as the new normal.

How do Interest Rates Affect Value and Pricing?

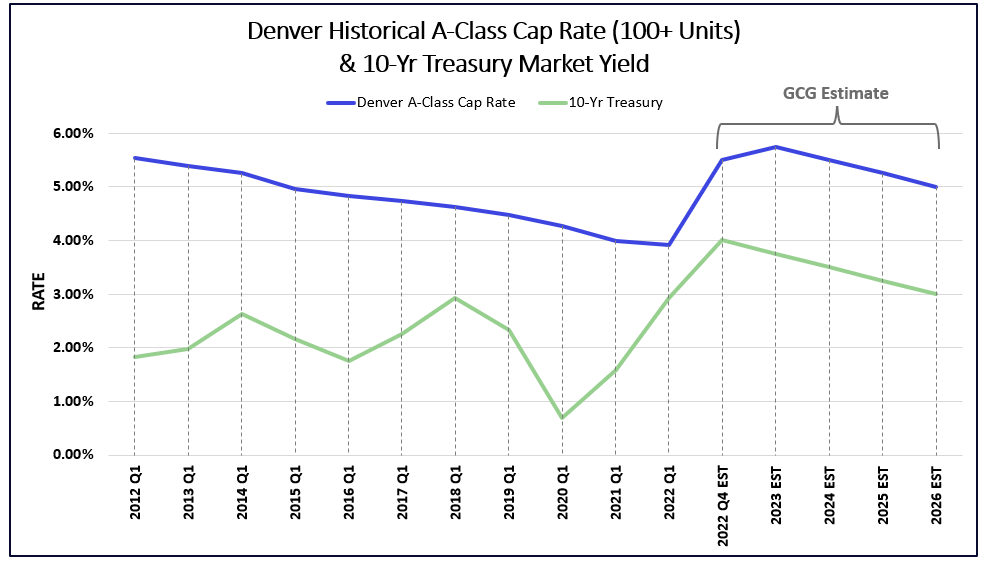

Granite Capital believes the 10-year Treasury Note already reflects a future, long-term period of low inflation and low growth within the U.S. economy. This important rate has seemingly stabilized in the 3.5% to 4.0% range with implied inflation in the 2.0% to 3.0% range.

The current rate for long-term fixed-rate mortgages is between 5.0% and 5.5% (previously 3.0% to 4.0%). Higher mortgage rates drive real estate returns lower by reducing cashflow. In turn, lower cashflow reduces loan proceeds. The combined effect of lower cash flow and loan proceeds (leverage) is lower returns to investors and ultimately in lower values. As short and long-term treasuries maintain their current levels, commercial real estate values need to fall to provide investors a reasonable return. We expect a decline of approximately 30% from the peak prices seen in early 2022 prior to the implementation of Federal Funds Rate increases.

As one might expect from a quickly changing market, there is currently a separation between seller pricing expectations (pre-inflation pricing) and buyers’ willingness to buy (based on the current long-term interest rates and alternative investments. Over time, these two dynamics will merge at a pricing level acceptable to buyers and sellers. This correction has already begun and will increase in intensity as the year progresses. In strong primary and secondary markets, we anticipate a cap rate shift from the previous roughly 3.75%, to5.50% on high quality assets. Assets of lesser quality will be accorded higher cap rates and lower prices.

A reduction of available investment capital will reduce the ready buyer pool. For the last decade significant capital has been sitting on the sidelines ready to enter the market. However, as the Fed reduces their balance sheet (retiring assets from their balance sheet while not purchasing new assets) over the next two years, liquidity in the market is expected to tighten. Tighter capital means less will be available to loan and invest. The Fed wrote, “Over the fourth quarter, major net shares of banks reported tightening standards for all types of commercial real estate loans. Meanwhile, major net shares of banks reported weaker demand for loans secured by nonfarm nonresidential properties and construction and land development loans, and a significant net share of banks reported weaker demand for loans secured by multifamily properties.” As lenders are now held to tightened underwriting requirements and as capital is used to shore up personal and corporate balance sheets, less capital will be available to invest thus contributing to softer pricing.

Summarizing this New Cycle

The bad news is that higher cap rates, driven by higher interest rates, have forced a reduction in commercial real estate prices of 30% from recent highs. The good news is that lower prices create a buying opportunity for groups that are well positioned to execute. We do not expect a 2008 residential market “crash” because enough multifamily real estate has benefited from significant recent rent growth and enjoys fixed-rate debt. Assets with fixed-rate debt will continue to perform well as rents and occupancies in most markets remain strong.

We expect to see short-term interest rates stay relatively constant for the next 24 to 36 months until the Fed meets its target of 2.0% sustained inflation and the 10-year Treasury rate to stay consistent with current rates until the end of the decade. With rates higher, long-term commercial real estate values are headed lower and cap rates higher in the short term. Over the long term however rental housing will benefit from significant shortages and is well positioned to realize strong value growth. Berkadia EVP and head of production Ernie Katai said this year that “as real estate investors adapt strategies and investment decisions to shifting market conditions, we remain sanguine about multifamily investing, fundamentals and operations while this shift is coupled with headwinds and economic uncertainty, this environment is nothing we haven’t conquered before, and in fact, we believe we are reverting back to national historic averages.”

GCG Portfolio

Granite Capital Group believes that our current portfolio of assets is well-positioned. All projects have fixed- rate loans that extend to 2025 through 2027 and our properties are providing solid cashflow. Original underwriting assumed higher interest rates and cap rates over an investment term of 7 or more years from the acquisition. Our construction projects were conservatively underwritten and include critical components for success. Good locations, low land basis, and significant recent market rent growth have all exceeded our underwriting projections. Overall, our properties are in markets with solid occupancy and rent growth and we expect our portfolio to perform well over the remaining decade.

In the last three years when many investors joined the acquisition frenzy and exposed themselves to the peril of refinance risk, GCG stuck to a conservative underwriting approach and avoided the acquisition of value- add or existing (built) partnership property. When interest rates were near zero, a 9.0% to 12.0% return looked appealing. Many transactions over the last three years were based on this target. Over the same three years, GCG required a return closer to 18.0%; and found no opportunities.

Conclusion

We believe our prudence has put us in a good position to be an opportunistic buyer in the coming phase of this economic cycle. Granite Capital Group is closely monitoring our markets for distressed sellers and is prepared to act when there is an appropriate entry point. We will acquire property only when it meets our return criteria, an underwriting decision driven by price, interest rates, and an ever-prudent evaluation of risk versus return.

GCG continues to minimize risk based on solid economic data while being deliberate and conservative when underwriting projects. Using our datasets and benchmarking to formulate opinions, we will seek returns of 13.0% to 16.0% for core property and 17.0% to 20.0% for value-add and development projects.

Currently, the market requires further time to adjust. Through conversations with brokers in our core markets of Denver, Salt Lake City, and Seattle, we are hearing about owners that will need to sell in 2023 with limited buyers willing to buy. We expect the gap between sellers and buyers to narrow considerably in the year ahead.

Granite Capital Group is a midsize entrepreneurial real estate firm that targets the acquisition of unique investments to build wealth while managing to create maximum value for our investors and clients. Thank you for your trust in us and the investments we sponsor. Should you have any questions please feel free to contact us.